Tree-based conditional portfolio sorts: The relation between past and future stock returns,

(former title: Deep conditional portfolio sorts: The relation between past and future stock returns)

with Tom Zimmermann,

- 2013 – Our first presentation in Harvard Research Seminar in 2013: Presentation (pdf)

- 2014 – Our first working paper: Paper (pdf)

- 2014 – An extended presentation in 2014: Presentation (pdf)

- 2015 – Best Paper Award at the Annual Meeting 2015 of the German Finance Association (Deutsche Gesellschaft für Finanzwirtschaft)

- 2016 – Cited in an article on the examination of the research process and principles underlying successful models used in quantitative equity strategies.

Cerniglia, J. A., Fabozzi, F. J., & Kolm, P. N. (2016). Best Practices in Research for Quantitative Equity Strategies. The Journal of Portfolio Management, 42(5), 135-143.

“Researchers in finance are applying these newer methodologies to create insights into the dynamics of equity markets. Moritz and Zimmermann [2014] address the research question of which variables provide independent information about the cross-section of stock returns.” - 2017 – Cited in an article on applying machine learning to economics.

Mullainathan, Sendhil, and Jann Spiess. (2017). Machine Learning: An Applied Econometric Approach. Journal of Economic Perspectives, 31(2), 87-106.

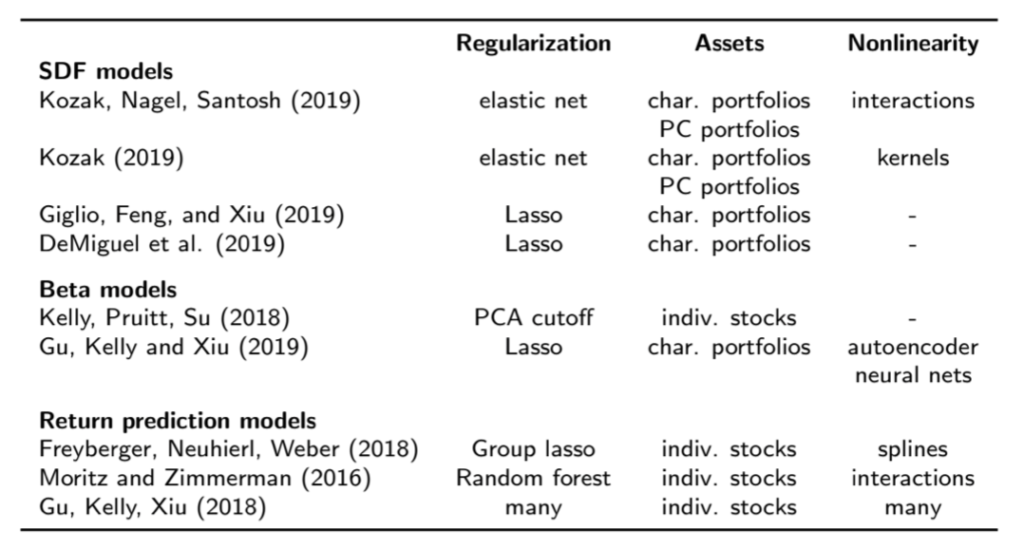

“A final application of supervised machine learning is to test directly theories that are inherently about predictability. Within the efficient markets theory in finance, for example, the inability to make predictions about the future is a key prediction. Moritz and Zimmermann (2016) adapt methods from machine learning to show that past returns of US firms do have significant predictive power over their future stock prices.” - 2019 – Cited in a lecture given by Stefan Nagel

Princeton Lectures in Finance 2019: Machine Learning and Asset Pricing

https://voices.uchicago.edu/stefannagel/discussions/

The Relation between Stock Market Risk and Return

with Stefan Mittnik,

- Chapter 2 of my PhD Thesis: Link

Modern Asset Management

with Christian Maschner and Martin Schmitz

Applications of Textual Analysis and Machine Learning in Asset Pricing

My 2018 Phd Thesis and the Slides from my Defense

- 2020 – „Advancement Award for Artificial Intelligence in the Financial Sector“ of Plexus Investments

Applied Research

Interview with Linda Kreitzman from University of Berkeley – November 2020

Factor of the month: Momentum – March 2021

Factor of the month: Free Cash Flow – April 2021

Factor of the month: Value – May 2021

Factor of the month: Traditional factor strategies – June 2021

Factor of the month: Momentum Europa vs US – July 2021

Factor of the month: Low Volatility – August 2021

Factor of the month: Small Caps with high Momentum – September 2021

Factor of the month: Tangible Common Equity to Market Cap – October 2021

Factor of the month: ESG as a source of alpha – November 2021